find a mortgage that fits your life

How the process works

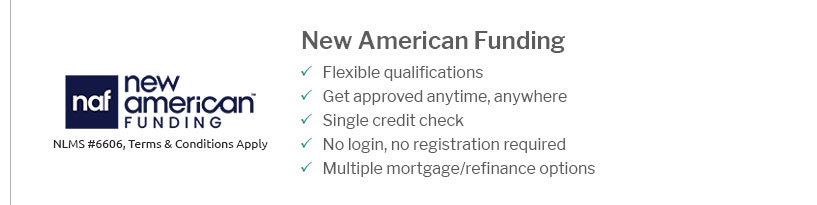

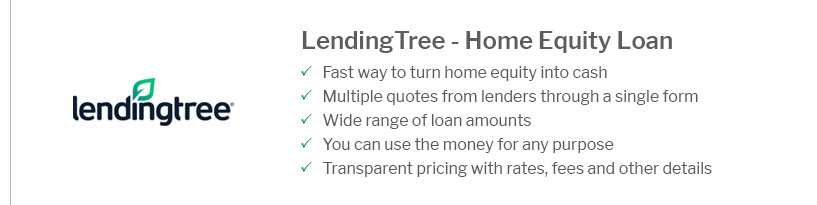

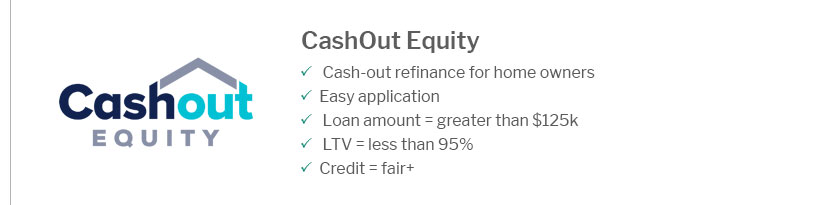

Getting a home loan can feel complex, but the steps are straightforward when you break them down. Start by mapping a realistic budget, then review your credit and debts. Compare offers from multiple lenders, request preapproval, and choose a term that matches your plans. Finally, lock your rate and prepare for closing.

What to compare

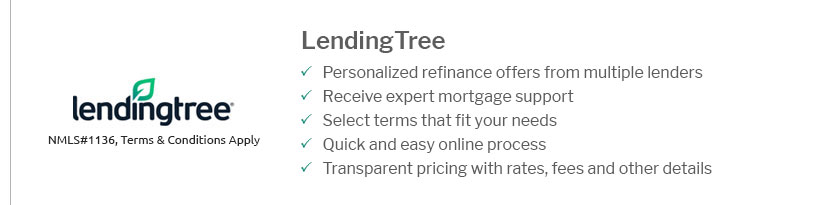

Look beyond the headline rate. The APR reflects fees and points, so it’s a fairer yardstick. Ask about closing costs, mortgage insurance, and whether there’s a prepayment penalty. Evaluate fixed versus adjustable options, payment flexibility, and the service reputation of each lender you’re considering.

- Gather pay stubs, tax returns, and bank statements.

- Aim for a down payment that preserves savings.

- Request at least three quotes on the same day.

- Compare the loan estimate line by line.

- Ask how long a rate lock lasts.

- Confirm timelines for appraisal, title, and closing.